The Supremes

Sometimes, the shortest sentences are the most cutting. According to Kayleigh McEnany, all three branches of government have failed her caudillo. Hate to see it.

Eggnog?

FTC v. Facebook

I’m very surprised there is not a lot more discussion about the FTC’s broadside against Facebook. As I write this on Saturday, my article is still the only one on the subject over at Seeking Alpha, and frankly readers do not seem that interested. But at the risk of boring you…

The main part of the claim regards the Instagram and WhatsApp acquisitions.

This all comes at a time when Facebook was really struggling to pivot to mobile. Their mobile app was just awful.

An app at a key user access point like photos or messaging came out and was very successful. Users grew quickly.

Zuckerberg noticed before anyone else at the company, and pushed engineering to make a competing product to squelch the competition.

Zuckerberg becomes afraid that these apps will slowly add social-media features that will compete with Facebook. That they are at very common access points, photos and messages, reduces friction a lot.

They were just as afraid that Apple or Google would buy them.

The internal competitor doesn't develop fast enough for Zuckerberg’s taste, and he shifts his focus to overpaying for the company if necessary as the competitor continues to grow on mobile. As you see, he is very explicit that it is to stop a viable competitor from developing.

They do just that.

It will be very hard for Facebook to deny that any of this is in fact true, because of star witness for the prosecution, Mark Zuckerberg.

It is better to buy than compete.

We can likely always just buy any competitive startups.

I remember your internal post about how Instagram was our threat and not Google+. You were basically right. One thing about startups though is you can often acquire them.

[Instagram leaves Facebook] very behind in both functionality and brand on how one of the core use cases of Facebook will evolve in the mobile world… We might consider paying a lot of money.

[Facebook] Snap might be a good first step but we’d be very behind in both functionality and brand on how one of the core use cases of Facebook will evolve in the mobile world, which is really scary and why we might want to consider paying a lot of money for this.

[I]’m the most worried about messaging. WhatsApp is already ahead of us in messaging in the same way Instagram was ‘ahead’ of us in photos… I’d pay $1b for them if we could get them.

Even if some new competitors spring up, buying Instagram, Path, Foursquare, etc now will give us a year or more to integrate their dynamics before anyone can get close to their scale again. Within that time, if we incorporate the social mechanics they were using, those new products won’t get much traction since we’ll already have their mechanics deployed at scale.

[On Twitter turning down their offer] I was looking forward to the extra time that would have given us to get our product in order without having to worry about a competitor growing.

If [my analytical] framework holds true, then we should expect apps like Instagram to be able to grow quite large… We should perhaps be more open to buying these companies than we currently seem to be.

One business questions [sic] I’ve been thinking about recently is how much we should be willing to pay to acquire mobile app companies like Instagram and Path that are building networks that are competitive with our own.

All those are direct quotes from Zuck’s emails. Is any of this a violation of the Sherman Antitrust Act Section 2 as claimed by the FTC, 46 state Attorneys General, D.C., and Guam? Hell if I know; ask an antitrust lawyer. But my point is that Facebook cannot argue the facts; Zuck is too explicit. They will have to argue the law.

The other part of the claim is less persuasive to me — that Facebook used the APIs of the Facebook Platform to hinder competition by blocking access for promising competitors. It’s one thing to take out a competitor, but I am not sure why Facebook should be forced to host and actively abet their competitors, which is essentially what the FTC claims.

The example that sounds the worst is Path, because it links with the first set of charges. After multiple failed overtures to purchase Path, Facebook cut off their access to Facebook Platform APIs, and their growth slowed significantly. Path is no longer with us. But both the founders of Path were ex-Facebook, and it’s astounding to think they were so naive as to think that Zuck would just let them sit there and steal users.

But if the FTC is successful on that part of the claim, anyone with an app store platform is at risk. That’s Apple, Google, the game console makers, and a host of others.

Anyway, the lessons of US v Microsoft still apply:

This will take a very long time. US v. Microsoft was almost 6 years from first complaint to the final settlement.

There will be many twists and turns.

By the time it is over, the tech landscape may have changed to an extent that the case seems a little besides the point. Tech moves faster than the courts.

The cost to Microsoft was mostly in loss of corporate focus, and the creation of a bunker mentality.

Stay tuned; long road ahead. The bigger risk to Facebook is not what happens at the end of that road, but the loss of focus along the way.

Spreadsheet Fun

Just to be clear, I would watch Zach’s Excel Twitch channel.

So when October income/PCE and November jobs dropped, I was sort of bored. They showed the same trends of slowing recovery I have been tracking since the end of summer. The employment-population ratio even dropped in November:

So the recovery has sort of come to a halt and the reason is the COVID surge. We’ll get to that in the next section.

I think there’s pretty strong agreement that this is going to a long hard winter. But as winter turns to spring, moderating weather and vaccine distribution will begin ameliorating the situation. The vaccine bottleneck right now is production and there will necessarily be rationing. This is going to be another shit show, but I believe in the end, we can convince enough Americans to take the vaccine. I still don’t know what the early rationing plan in the US is.

The next bottleneck will be distribution. Most Americans live in more densely populated parts of the country, and there is a lot of excess retail capacity in supermarkets, pharmacies and warehouse stores. But there will be distributional issues for the ~75 million Americans who do not live in urban or suburban areas with dense retail capacity.

So it looks like a very tough winter, followed by amelioration in spring, and an end to the public health crisis by the end of spring. What comes next?

So I made a very simple spreadsheet to game out what the US economy could look like a year from now. The primary variable is how much of the household savings bubble gets spent in H2 2021.

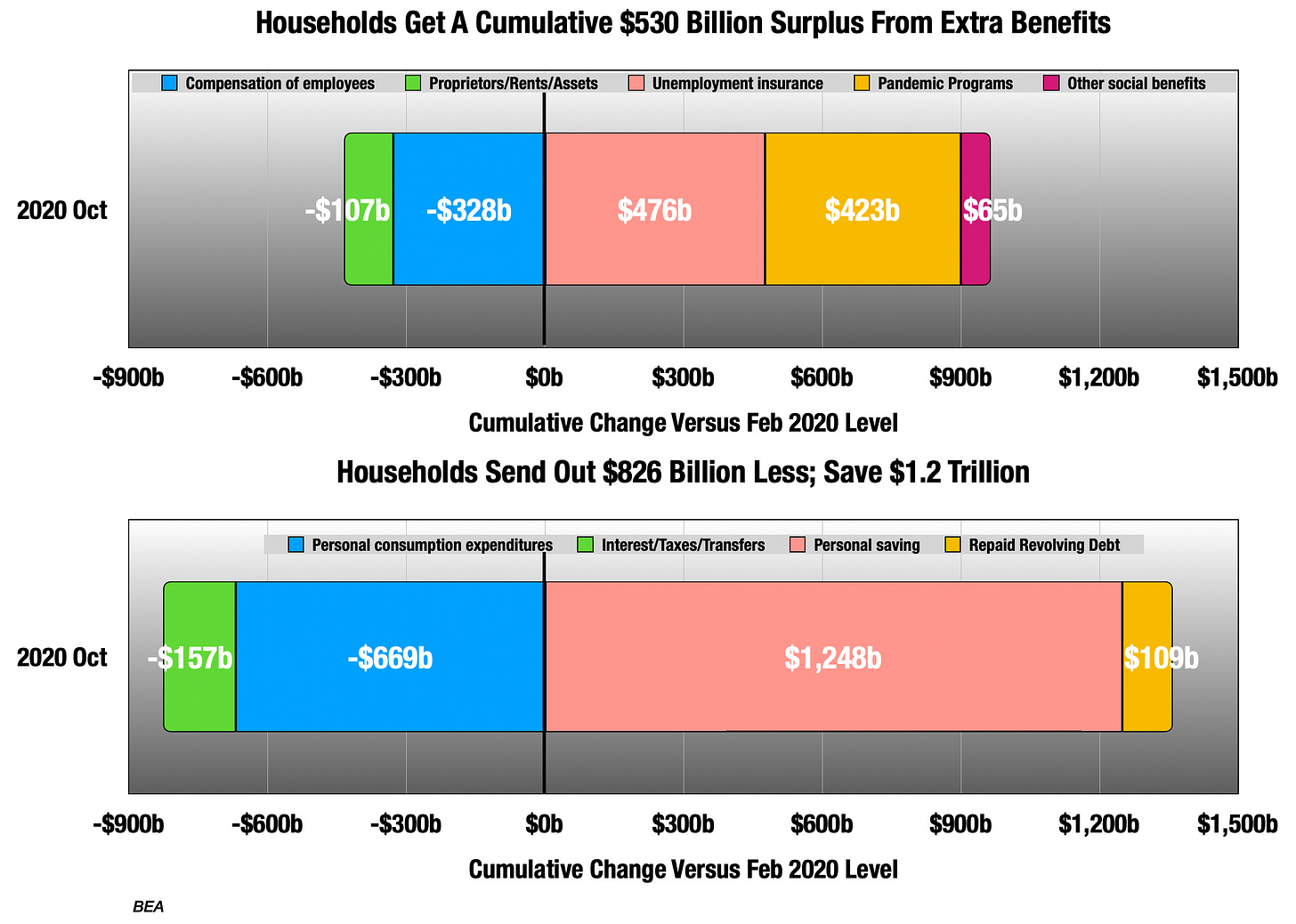

Those boxes represent the cumulative change versus the February level, so 8 months into it through October.

Between employee compensation, proprietor’s, rental and asset (just dividends and interest, not capital gains) income, US households got $435 billion less.

But there was an additional $965 billion in government benefits offsetting the income losses, for a surplus of $530 billion in income.

That surplus went unspent, and then some, a cumulative reduction of $699 billion in consumption. Add to that $157 billion less going out the door from taxes, interest and transfers, for a grand total of $826 billion less going out.

Add that $530 billion and $826 billion and you get a cumulative savings bubble of almost $1.4 trillion through October.

Households used $109 billion of that to pay down revolving debt, most of that happening back in the spring, but the level had come down every month of the pandemic.

But that bubble is likely in the hands of high-income households who are doing just fine.

My best guess is they will just add most of it to future savings. But you can play around with it in the Google Sheet, and see what happens under different post-pandemic scenarios. It’s not a real economic model, just a look at how influential this savings bubble can be by this time next year.

Probably best if you read about it first here. Scroll down to “A Year From Now.”

COVID Update

It’s very bad.

We are now in the last few days of the Thanksgiving reporting anomaly, which as you can see is particularly deep, but following the same patterns as the other holidays:

First, under-reporting. The people who compile the data need days off too.

Then, make up over-reporting.

Then, the moving average line turns down from the over-reporting as the actual case rate comes into focus.

So you can see on the far right of that chart that we are almost done with stage 3. Actual trends should be apparent in a few days.

The big story in October and November were the Mountain and Central regions, home to 85 million. As you can see, the case rates far exceeded any of the earlier surges in the Northeast or Sunbelt. Looking at European nations like Belgium and Spain that had similar fall explosions of cases, it seems like there’s a natural ceiling around 1000 cases/million. People change their behavior even absent government action. Anyway, the dips there preceded Thanksgiving, so I expect those lines to keep coming down for a while, but how far?

But the bigger story now is the Sunbelt, Northeast and Mid-Atlantic, now all up around 600 cases/million, much worse than earlier surges already. That’s home to 231 million. California and New York have re-instituted shutdowns, so the case rates should start coming down quickly, but other places are not taking as harsh measures.

But regardless of what happens next, there is a bitter harvest of deaths coming. We are at 16,650 in the week ending Saturday. By January we should be at 25k deaths/week. Steel yourself for The Ugly.